Euro Credit Holdings Ltd | Rhys Aldous | Caution Advised on Stock Loans

Euro Credit Holdings – Rhys Aldous – Caution Advised Regarding Stock Loan Dealings

ChatGPT said:

Note – This review has been published following requests from our clients’ legal representatives to help raise awareness and encourage caution when engaging in stock loan transactions involving third parties.

Update (29/03/24): We have been informed by several established lenders that there has been a noticeable increase in broker due-diligence inquiries since the publication of this article. This aligns with our objective of promoting transparency and reducing the risks of clients and brokers engaging with unverified or unregulated entities in the stock loan market.

Our ongoing goal is to encourage higher industry standards and ensure that only reputable, verified providers remain active within the stock loan sector.

We’ve also experienced a strong rise in inquiries from brokers and clients actively seeking introductions to genuine, regulated lenders.

15th March 2024 – Investor Warning Issued. Investors Take Note

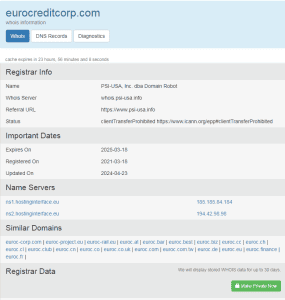

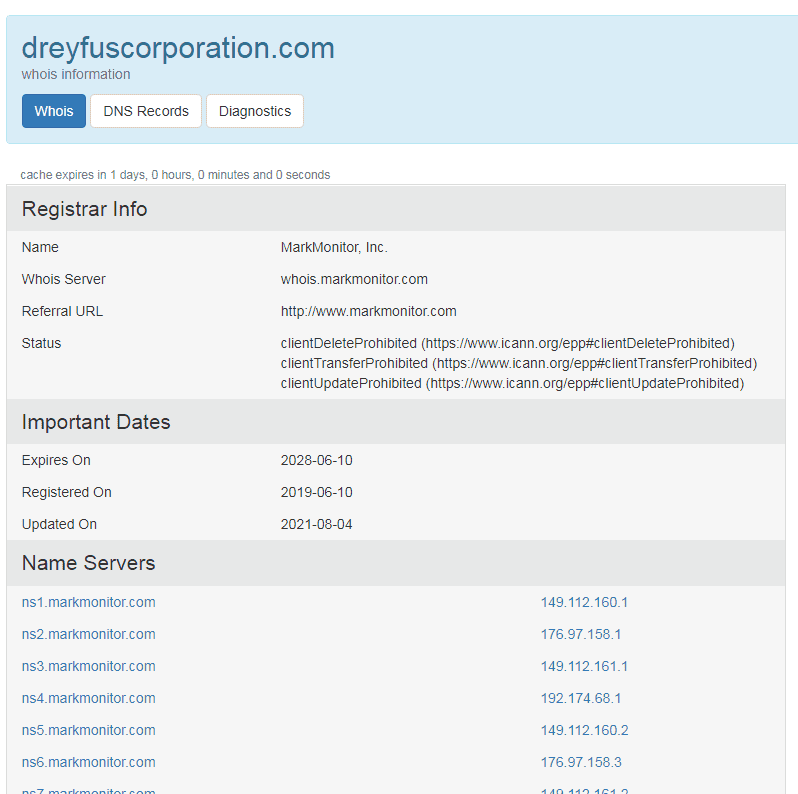

United Kingdom – Financial Conduct Authority – FCA – Euro Credit Holdings were previously Dreyfus Corporation

https://www.fca.org.uk/news/warnings/dreyfus-corp

Monetary Authority Singapore: Investor Alert Issued: Euro Credit Holdings Limited

Link Here: https://t.ly/QrcIu

Money Smart – Australian Government Warning Website – Euro Credit Holdings Limited

We are preparing a detailed review of Euro Credit Holdings Ltd and Rhys Aldous to highlight issues our client experienced with a stock loan transaction. In this case, only a small portion of the intended stock loan was funded, while the client’s shares remained with the provider.

Our client is currently pursuing legal avenues to recover their stock. They have also contacted the stock exchange for guidance regarding shares that may have been transferred or sold.

The full article, to be published in the coming weeks, will provide an in-depth account and offer guidance on best practices and precautions for anyone engaging in stock loan transactions.

We advise exercising caution and thorough due diligence when considering stock loan providers such as Euro Credit Holdings and Rhys Aldous, and recommend verifying funding arrangements and custodian practices before proceeding.

This article is intended to inform and protect clients from potential risk in the stock loan market. References to other online sources discussing experiences with this provider will also be included.

Important Considerations Regarding Euro Credit Holdings Ltd and Rhys Aldous

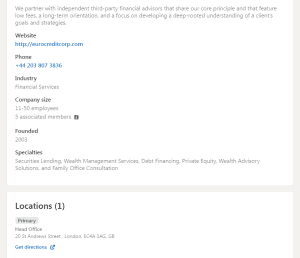

One notable aspect for clients and brokers to verify is the use of multiple business addresses by Euro Credit Holdings. Many of these addresses are virtual offices, which may give the appearance of a larger operation than actually exists.

Prospective clients should ask themselves whether a company claiming to manage large stock loans can realistically operate without sufficient staff or physical offices. Transparency about team size and operations is an important factor when assessing any stock loan provider.

We encourage anyone considering stock loans to conduct thorough due diligence, including verifying office locations, staff, funding history, and regulatory compliance. Independent verification from regulators or trusted third parties is strongly advised before engaging in any transactions.

15 St Helens Place

20 St Andrews Street

11 St Pauls Square

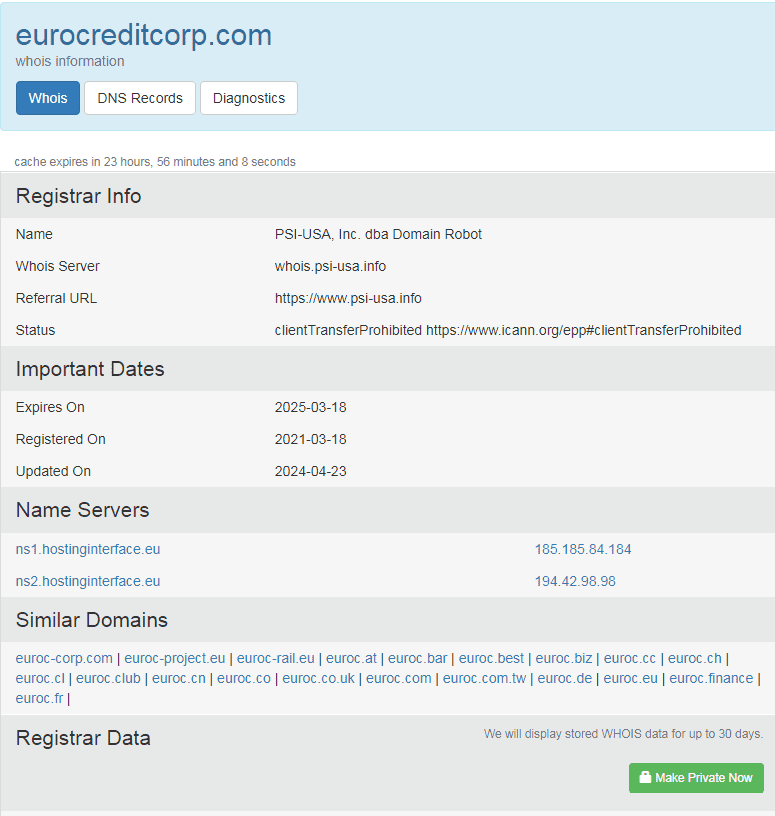

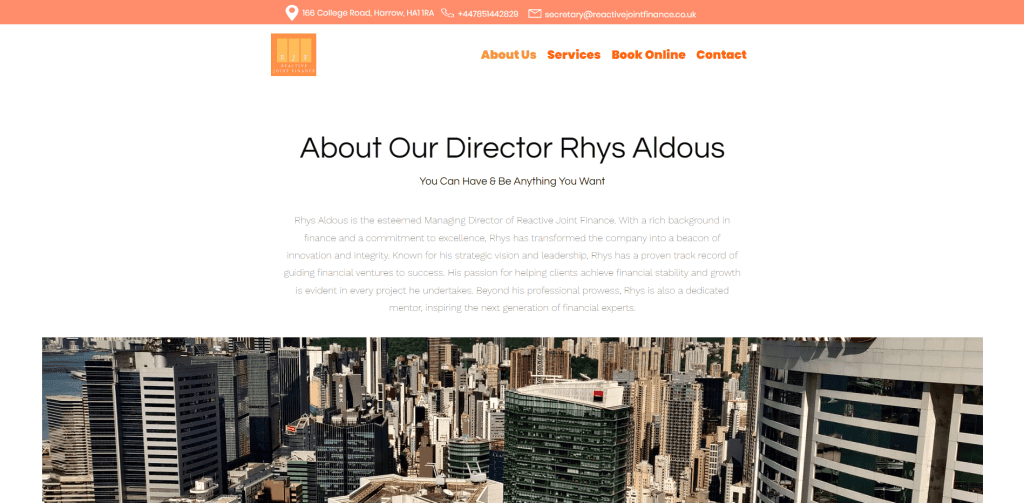

Timeline Inconsistencies – Euro Credit Holdings Ltd and Rhys Aldous

One area that prospective clients should scrutinize carefully involves inconsistencies in communication timelines or transaction updates. In the stock loan industry, unclear or shifting timelines can be a warning sign that warrants deeper verification.

When key dates, funding milestones, or documentation deadlines appear to change without clear explanation, it becomes difficult to confirm the legitimacy or progress of a transaction. This uncertainty can cause clients to become overly dependent on the intermediary or provider for information.

We recommend maintaining written records of all correspondence, verifying all stated timelines against official documentation, and ensuring that all funding commitments are clearly supported by third-party verification.

Dreyfus Corporation 10th June 2019

Euro Credit Holdings 18th March 2021

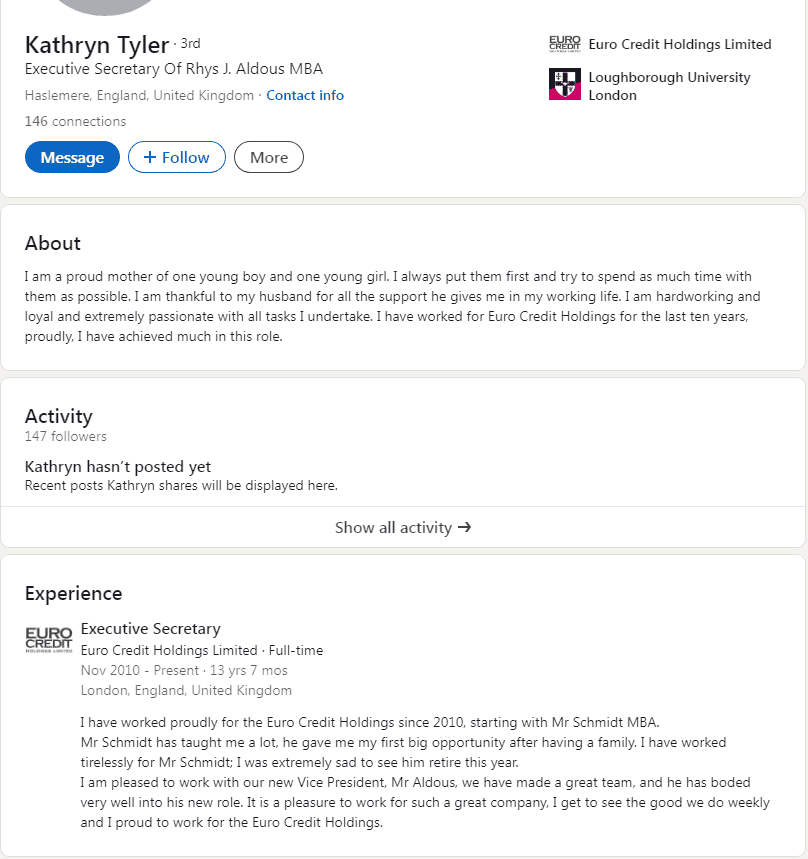

Kathryn Tyler – Worked At Euro Credit Holdings Since 2010

Dreyfus Holdings

Euro Credit Holdings

Reactive Joint Finance

Explanation Inconsistencies – Euro Credit Holdings Ltd and Rhys Aldous

According to statements from Rhys Aldous, Dreyfus Holdings Ltd was reportedly taken over by Euro Credit Holdings. However, no public record or media release appears to confirm such a transaction. Typically, legitimate corporate acquisitions are supported by official announcements or regulatory filings that can be independently verified.

Additionally, there is no record of a UK-registered company under the name Euro Credit Holdings Ltd at Companies House, which raises questions about the business’s legal structure and jurisdiction.

The former website associated with Dreyfus Holdings is no longer active and does not redirect to any successor company. In standard practice, a 301 redirect or formal communication would be used to inform existing clients and ensure continuity following a legitimate acquisition.

These inconsistencies highlight the importance of verifying a company’s registration details, checking for public takeover notices, and confirming that key personnel can be independently verified. When such information is unavailable or contradictory, clients and brokers should proceed with caution and conduct further due diligence before engaging in any transactions.

Disappearance of Our Clients Shares.

Two clients engaged with Euro Credit Holdings, represented by Rhys Aldous, for a planned USD 40 million loan secured by USD 80 million in shares. The clients were asked to transfer their shares to the custodian Armira Capital. Shortly after the transfer, Euro Credit Holdings claimed a negative report required a revised funding structure.

Under the revised terms, the clients were to receive significantly smaller tranches of USD 500k each, instead of the originally agreed USD 20 million per client. Only two tranches were paid, totaling USD 1 million per client.

When the clients declined requests to provide tax returns—despite the loans being fully secured and non‑recourse—Euro Credit Holdings allegedly defaulted the clients, leaving USD 78 million in shares unrepaid despite repeated follow‑ups.

Subsequent litigation initiated by Euro Credit Holdings and Rhys Aldous against our directors and Platinum Global Bridging Finance was eventually dropped.

Selling Of Shares

While our clients were working with lawyers to recover their shares, they received emails from Rhys Aldous and Euro Credit Holdings offering to return the shares in exchange for a 10% “penalty” of USD 8 million. The clients declined and allowed their legal team to proceed.

Within a week, the lawyers were informed by the Singapore Stock Exchange that unusually large volumes of the shares were being sold, causing a sharp drop in market price. Based on the timing, it appears these sales may have been conducted by Euro Credit Holdings and Rhys Aldous.

Over three years later, the shares have not been recovered.

⚠️ Client Alert: Caution Advised with Euro Credit Holdings and Rhys Aldous

Platinum Global Bridging Finance advises extreme caution when dealing with Euro Credit Holdings and Rhys Aldous.

Publicly available information and client experiences raise significant concerns about the company’s practices, including delayed or partial loan disbursements and disputes over share custody.

Clients should be aware:

-

Loans may not be paid out as initially agreed, even when shares are provided as collateral.

-

Requests for additional payments or documents beyond standard procedures may be made unexpectedly.

-

Large volumes of shares may be sold without client consent, potentially affecting market value.

-

Recovery of shares or funds can take years, with no guarantee of resolution.

Before engaging with Euro Credit Holdings or Rhys Aldous, verify all claims with legal counsel and ensure that any transaction is fully backed by secure, licensed financial intermediaries.

Avoid sharing personal, financial, or tax information unless absolutely necessary and verified.

About Us

Platinum Global Bridging Finance is a distinguished high-net-worth finance broker. We specialize in providing tailored financial solutions, including Property Bridging Finance, Development Finance, Single Stock Loans, Margin Stock Loan, Crypto Finance, Crypto Loans and Commercial Property Finance tailored to meet the diverse needs of our clientele seeking robust financial lending solutions.

Other Financing Options We Offer

International Bridging Loans | Expat Mortgages | MUFB Mortgages | Portfolio Mortgages | United States Mortgages | Universal Life Insurance | Expat Life Insurance | Expat Health Insurance | Crypto Financing | Securities Backed Lending | Pre IPO Loans | OTC Stock Loans | Aircraft Financing | Unregulated Bridging Loans | Share Portfolio Loans | 144 Restricted Stock Loans | Crypto Backed Lending | Unlisted Stock Loans